Explore

Income for Life Solutions

Where Protection Meets Strategy—and Strategy Creates Legacy

What is an Income for Life Strategy?

Most founders and executives think of protection as a safety net — but what if it could also be a growth engine?

An Income for Life Strategy turns insurance into more than a safeguard. It becomes a financial engine—funding your retirement, buyouts, or legacy with guaranteed income that lasts as long as you do.

Because true protection isn’t just about minimizing risk — it’s about creating stability, liquidity, and control over the wealth you’ve worked so hard to build.

WHY THESE STRATEGIES WORK?

Flexibility

No Market Downside

Legacy Planning Built-in

Predictable Income

Tax Efficiency

Risk Elimination = Max Growth Potential

Properly Structured - Max Funded IUL Potential

"I sold my manufacturing business but I wasn't sure how to protect the proceeds. My advisor structured an annuity that will pay me $10,000 a month for life."

Jess P

Retired Business Owner

Protecting People. Preserving Profits. Planning Legacies.

Indexed Universal Life (IUL)

Tax-free income, lifelong coverage, and market-linked growth—

Without the Market Risk.

An Income for Life Policy transforms ordinary insurance into a personal or business wealth engine.

By leveraging Indexed Universal Life (IUL) policies or accumulation annuities; you create guaranteed income streams-paying out when you need it most:

- Retirement

- Succession or Buyout

- Legacy Planning

Every premium dollar becomes a working asset fueling dividends that outlive the business itself.

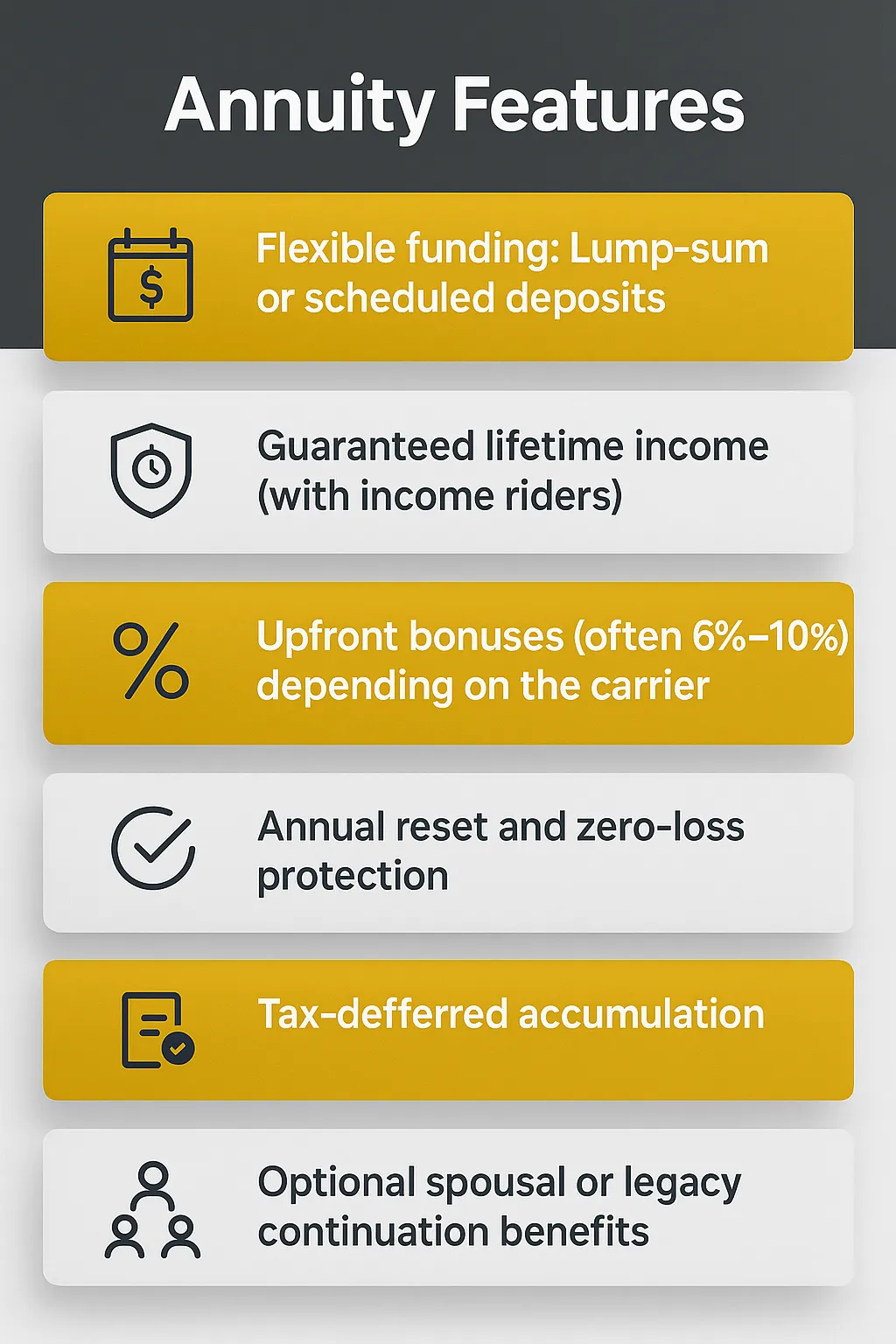

Indexed Annuities

Create guaranteed income for life—whether you're

ready now or planning for later.

An Indexed Annuity is a financial product that turns your savings into a stream of income you can’t outlive—while protecting your money from market losses.

With growth potential linked to a market index-out risk to your principal – indexed annuities are designed for the second reliable lifetime, income.

USE CASES

Business owners preparing for retirement

Individuals seeking to avoid market volatility

Pre-retirees, who want reliable income

Persons rolling over old 401(k)s and pension plans

Annuities aren't just for those near retirement.

They're for anyone who wants to guarantee an income,

without gambling on their future.

Secure Your Business, Worry-Free

Uncertainties can strike anytime, but with the right coverage, your business and legacy stay strong. Protect your assets, employees, and future with coverage that gives you peace of mind. We’ve got you covered—every step of the way.

Shadow Assets is more than a newsletter — it’s a private briefing into the unseen strategies of wealth.

Learn how protection becomes power, structure becomes stability, and every asset holds the potential to build a lasting legacy.

QUICK LINKS

RESOURCES

© Founder's Protection Suite. 2026. All Rights Reserved.